Bitcoin December Outlook 2025: Liquidity Weakens, Market Structure Softens, but Long-Term Thesis Remains Strong

Executive Summary

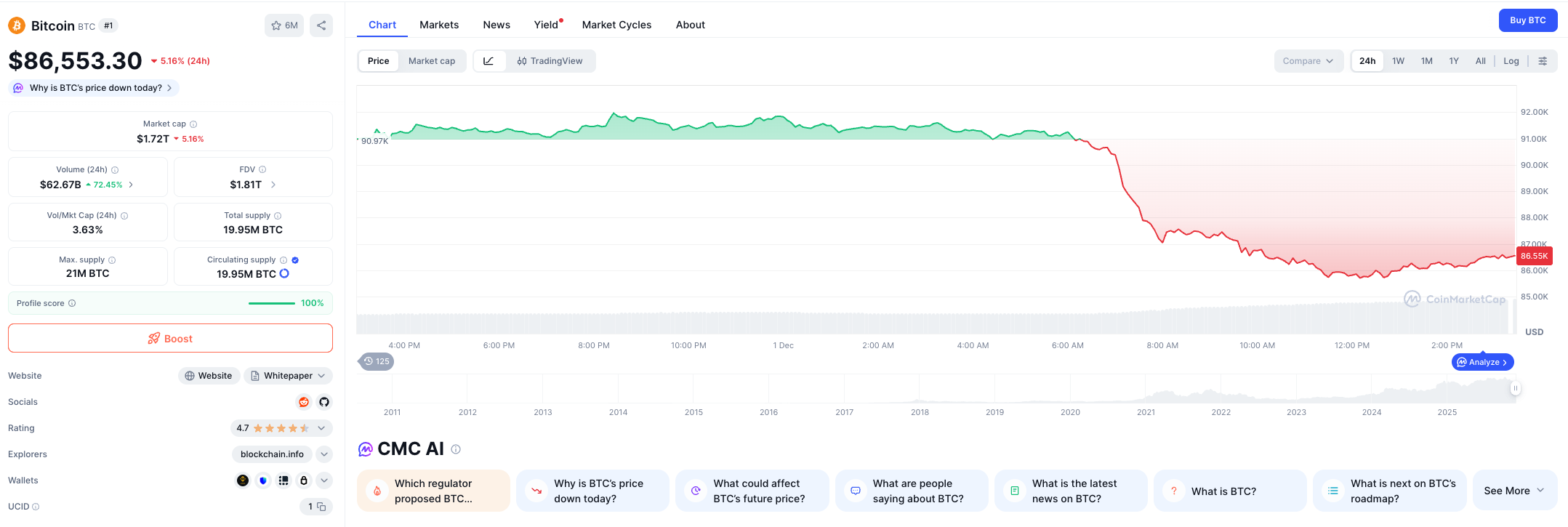

Bitcoin enters December 2025 under notable downward pressure, trading at $86,540, a sharp 31% retreat from its $126,000 October peak. Despite short-term fragility in market structure, Bitcoin’s long-term fundamentals remain exceptionally robust: supply scarcity intensifies, institutional involvement deepens, and on-chain metrics indicate strengthening conviction among long-term holders.

Source : Coinmarketcap

1. Market Microstructure: A Fragile Ecosystem Under Stress

Current order book conditions show a contraction in liquidity across major exchanges. This thinning of bids causes sell pressure to amplify, resulting in deeper price movements than would normally occur in a more liquid environment.

Whale distribution has increased moderately over the past 48 hours. Yet, on-chain flows reveal complexity: a significant portion of these large transactions move into cold storage, signaling strategic repositioning rather than capitulation.

The market is fragile, but not structurally broken.

2. Macro Forces: The Primary Driver of Bitcoin’s Correction

Macro conditions remain the dominant narrative:

-

Escalating risk-off sentiment is reducing exposure to volatile assets.

-

Global investors are awaiting new inflation and interest rate data.

-

Portfolio rotation into defensive assets continues to accelerate.

Bitcoin’s correction is therefore not merely technical — it reflects a broader repricing of risk across global markets.

3. The Strategic Bitcoin Thesis: Scarcity Dynamics Intensify

With ~19.95 million BTC already in circulation, the world is rapidly approaching the final stages of Bitcoin’s hard-cap narrative. Historically, steep corrections before supply constrictions have led to powerful accumulation phases.

Key on-chain indicators support this view:

-

Long-term holder supply is rising, signaling strong conviction.

-

Exchange reserves continue to drop, reducing readily available BTC for sale.

-

NVT ratios remain healthy, confirming consistent network value relative to activity.

The long-term thesis remains intact: Bitcoin continues evolving as a digital hard asset with increasing scarcity.

4. Forecast Scenarios for December 2025

Base Case (Neutral)

Bitcoin trades between $80,000–$92,000, forming a new consolidation range while awaiting macro clarity.

Bull Case (Optimistic)

A dovish shift in global monetary policy or strong institutional inflows could propel BTC back toward $100,000 in Q1 2026.

Bear Case (Defensive)

If macro risks intensify, BTC could revisit the $72,000–$78,000 liquidity zone before attempting a recovery.

5. Institutional Takeaway: Accumulate, Don’t Chase

Short-term volatility presents strategic accumulation opportunities, especially for funds seeking long-term exposure. Layered buying, rather than breakout chasing, offers a more risk-efficient approach given current conditions.

Bitcoin’s structural value proposition — scarcity, decentralization, and global adoption — remains unchanged. The correction is significant, but the long-term trajectory appears unaltered.

Final Conclusion

Bitcoin is experiencing one of its deepest corrections of 2025, yet core fundamentals remain solid. The asset continues to demonstrate its resilience as both a speculative and strategic store of value. As macro conditions evolve, Bitcoin’s next major movement will likely be shaped by institutional flows, global liquidity trends, and on-chain investor behavior.